Calculate VAT-inclusive and VAT-exclusive prices instantly

Value Added Tax (VAT) calculations can be confusing, whether you’re a business owner pricing products, a freelancer invoicing clients, or a consumer trying to understand your receipts. A VAT percentage calculator simplifies these calculations, ensuring accuracy and saving valuable time in your daily financial tasks.

This comprehensive guide will walk you through everything you need to know about VAT calculations and how to use online tools effectively.

Value Added Tax (VAT) is a consumption tax applied to goods and services at each stage of production and distribution. Unlike sales tax, which is only applied at the final point of sale, VAT is collected incrementally throughout the supply chain.

While both are consumption taxes, they work differently:

Some countries also have reduced rates for essential items like food, books, or medical supplies.

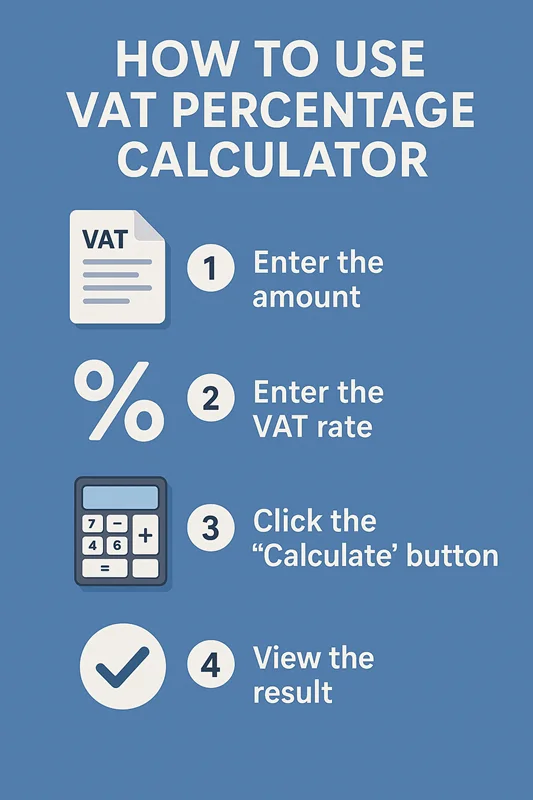

A VAT percentage calculator helps you perform two main calculations: adding VAT to a net price and removing VAT from a gross price. Here’s how to use these tools effectively:

Step 1: Enter the net price (price before VAT) Step 2: Select or enter the VAT rate percentage Step 3: Click “Calculate” to get the gross price (including VAT)

Formula: Gross Price = Net Price × (1 + VAT Rate/100)

Step 1: Enter the gross price (price including VAT) Step 2: Select or enter the VAT rate percentage Step 3: Click “Calculate” to get the net price (excluding VAT)

Formula: Net Price = Gross Price ÷ (1 + VAT Rate/100)

Let’s work through practical examples to illustrate how VAT calculations work in real-world scenarios.

Scenario: You’re selling a product for £100 (net price) and need to add 20% VAT.

Calculation:

Scenario: A customer paid £240 including 20% VAT. What was the original price?

Calculation:

Scenario: Adding 15% VAT to a £500 service fee.

Calculation:

Scenario: Total invoice amount is €1,150 including 15% VAT.

Calculation:

Manual VAT calculations are prone to human error, especially when dealing with:

Online VAT calculators provide instant results, eliminating the need for:

Business Owners:

Freelancers and Contractors:

Consumers and Shoppers:

Modern VAT percentage calculators work seamlessly across:

Inclusive VAT means the VAT is already included in the displayed price (gross price). Exclusive VAT means the VAT will be added to the displayed price (net price).

Calculate the VAT for each item individually, then sum up the total VAT amounts. Alternatively, add all net prices together and calculate VAT on the total.

Yes, many countries have multiple VAT rates. For example, the UK has a standard rate of 20%, a reduced rate of 5% for certain items, and 0% for some essential goods.

Using incorrect VAT rates can lead to overcharging or undercharging customers, tax compliance issues, and financial discrepancies. Always verify the correct rate for your location and product type.

VAT rates can change based on government policy, but changes are typically announced well in advance. It's important to stay updated with current rates for your region.

While similar in concept, VAT (Value Added Tax) and GST (Goods and Services Tax) have different implementation methods. GST is used in countries like Canada and Australia, while VAT is common in Europe and the UK.

Understanding VAT calculations is essential for businesses, freelancers, and consumers alike. Whether you’re preparing invoices, setting prices, or simply trying to understand your receipts, accurate VAT calculation ensures financial transparency and compliance.

A reliable percentage calculator eliminates guesswork and reduces errors in your financial calculations. By using online tools, you can quickly switch between adding and removing VAT, work with different tax rates, and handle complex scenarios with confidence.

Take advantage of VAT percentage calculators to streamline your financial processes and ensure accuracy in all your tax-related calculations. Try our calculator today and experience the convenience of automated VAT computations for your business or personal needs.